Wholesale price index inflation at record high of 15.9% on costly food, fuel – Times of India

[ad_1]

Data released by the department for promotion of industry and internal trade (DPIIT) on Tuesday showed inflation, as measured by the wholesale price index (WPI), rose an annual 15.9% in May, higher than the 15.1% in April and above the 13.1% recorded in May 2021. This is the highest inflation in the new series (2011-12) and the highest since the 16% posted in September 1999. WPI has been in double digits for 14 consecutive months, highlighting the entrenched price pressures.

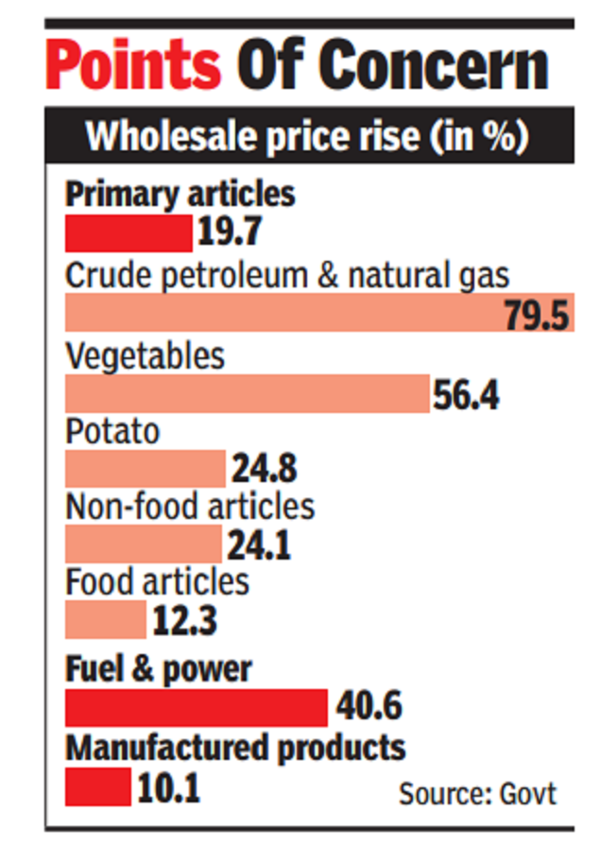

The high rate of inflation in May 2022 is primarily due to rise in prices of mineral oils, crude petroleum and natural gas, food articles, basic metals, non-food articles, chemicals and chemical products and food products as compared to the corresponding month of the previous year, according to the official statement.

Tuesday’s data showed food inflation at 10.9% was the highest since the 11.2% recorded in December 2019. There was a sharp rise in inflation of vegetables (56.4%), potatoes (24.8%), fuel and power (40.6%), and manufactured products (10.1%). The WPI data comes close on the heels of the retail inflation number for May, which displayed some easing from a near eight-year high of 7.8% in April to 7% in May.

Economists said the WPI inflation came in at 15.9% in May despite a high base, unlike the CPI number which was lower due to base effect.

“The divergence between the two indices is due to their differing composition. Unlike CPI, WPI does not include services, which are currently witnessing lower inflation compared with goods. Fuel inflation, which has remained high, has a much higher weight in WPI than in CPI. WPI can be taken as a proxy for input costs, which have risen sharply but have only been partly passed through to CPI due to uneven demand. Rising WPI will continue to maintain upward pressure on CPI,” said DK Joshi, chief economist at ratings agency Crisil.

Globally, inflation has emerged as a major risk after the war in Ukraine and the breakdown in supply chains due to the geopolitical conflict and the strict lockdown in China to prevent the spread of Covid-19. Central banks across the world have raised interest rates to stamp out price pressures. The Reserve Bank of India (RBI) has raised rates by 90 basis points in two tranches and more hikes are in the offing while the government has taken several measures to cool inflationary pressures.

Aditi Nayar, chief economist at ratings agency ICRA, said given the weight of oil and fuel items (~10.4%) in the WPI basket, the rise in global crude oil prices is expected to put upward pressure on the headline WPI print for June 2022. Further, the weakening of the rupee against the US dollar is likely to augment the landed cost of imports in the month, posing upside risks to the headline number. Consequently, the WPI inflation is likely to remain elevated at ~15-16% in June 2022. The weakening of the rupee and hardening of crude oil prices would transmit faster to the WPI than the CPI, she added.

“The rise in the WPI inflation, in contrast to the easing in the CPI inflation in May 2022, may imbue some caution into the outlook for monetary policy actions. We continue to expect 60 bps of repo hikes over the next two policy reviews,” said Nayar.

[ad_2]

Source link