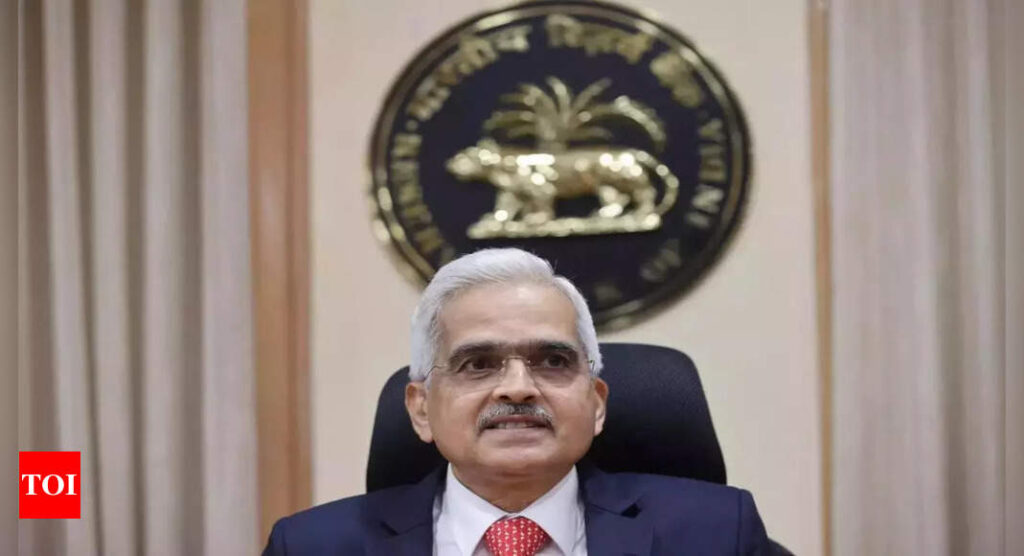

Shaktikanta Das: Big tech firms carry risks which need to be assessed; RBI Governor | India Business News – Times of India

[ad_1]

Speaking at a summit on banking, financial services and insurance (BFSI) in Mumbai, Das said that companies — whether from e-commerce, social media & search engine platforms, ride-hailing and similar businesses — have started to offer financial services in a big way on their own or behalf of others. “These companies have an enormous amount of customer data, which has helped them offer tailored financial services to entities and individuals lacking credit history or collateral. Even the banks and other lenders are sometimes utilising platforms provided by fintech companies in their internal processes for credit risk assessment,” said Das.

“But such loans could create systemic concerns like over-leverage and inadequate credit assessment, and authorities and regulators have to strike a fine balance between enabling innovation and preventing systemic risks,” said Das.

In his speech, Das also addressed the issue of recovery agents using abusive language with borrowers and their relatives, recordings of which had gone viral on social media. Promising touch action, Das said that if the borrowing was from entities not regulated by the RBI, complaints must be taken up with law enforcement agencies.

Responding to a question on licences for specialised digital banks, Das said that the RBI does not have plans for a separate regulatory framework for digital banks. He said that banks are already adopting technology in a big way, there was no need for a parallel entity, and it was possible to pursue digital banking aspirations within the current framework. “We felt that the suggestion (for digital bank licences) carries risks. Banks are free to change their model and focus more on harnessing technology,” said Das. He added that there was no plan for recognising neobanks or technology banks.

On the regulation of BigTech, Das said that the RBI is trying to see what are the terms of agreement they have with banks and non-banking financial companies (NBFCs). “There are only some things banks can outsource. There are various forms of lending that have now started. ‘Buy now, pay later’ is a kind of lending activity. We have to be careful and calibrated in our approach and cannot start interfering everywhere,” said Das. He added that the RBI would allow ecommerce firms to continue to offer ‘buy now, pay later’. “We are assessing what kind of leverage is there in the system. At an incipient stage we should not interfere and kill new ideas,” said Das.

In his speech, the governor said that what was seen so far in technology is only the tip of the iceberg. “The use of artificial intelligence and machine learning to determine the creditworthiness of clients by analysing data from a wide range of traditional and non-traditional data sources has the potential to enhance credit to marginalised customers,” said Das.

[ad_2]

Source link