RIL logs 41% higher profit in Q1, riding on refinery, retail & telco – Times of India

[ad_1]

Revenue totalled over Rs 2.23 lakh crore, up 55%, even as geopolitical conflict caused significant dislocation in energy markets. Operating profit, a yardstick for underlying business performance, increased 53% to Rs 39,562 crore.

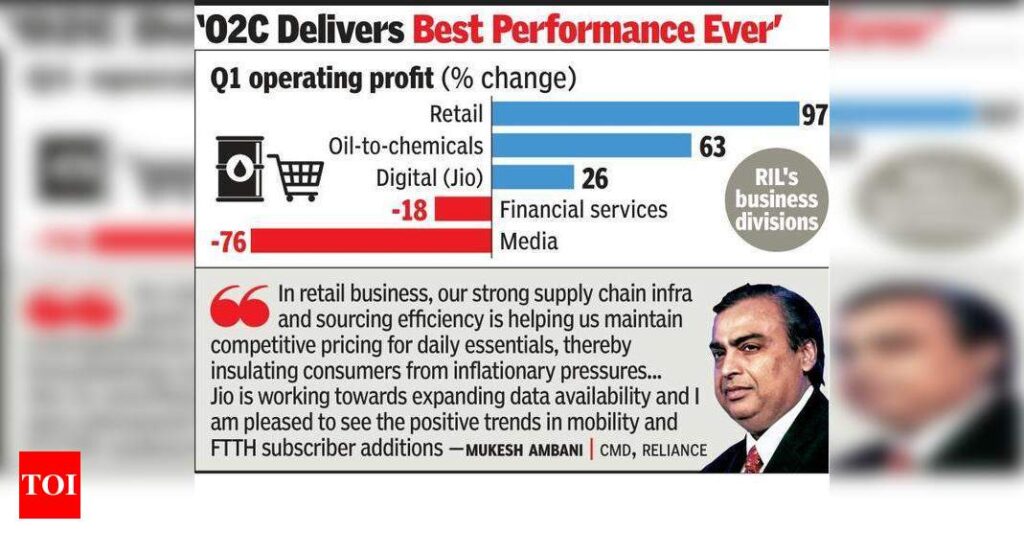

“Despite significant challenges posed by the tight crude markets and higher energy and freight costs, O2C business has delivered its best performance ever,” said RIL chairman & MD Mukesh Ambani. Operating profit of O2C grew 63% to Rs 19,888 crore, led by a sharp rise in transportation cracks and better volumes. The EU embargo on Russian oil products, higher gas to oil switching, strong travel demand and lower product inventory levels resulted in tight fuel markets, the company said in a statement. Profitability of Reliance BP Mobility, a fuels and mobility JV between RIL and BP in India, was adversely impacted on account of under recovery as retail fuel prices remained capped despite higher benchmark product prices.

Operating profit of digital (Jio) too climbed 26% to Rs 11,707 crore due to strong revenue growth and margin improvement. Jio’s average revenue per user (ARPU) — a key metric that influences income — was at Rs 175.7 in Q1FY23, up 27%. ARPU is the total revenue of the telecom operator divided by the number of users on its network. Launched in 2016, Jio has about 420 million customers as of June 30 and saw data and voice traffic growth of 27% and 17%, respectively, on its network.

Operating profit of the retail business zoomed 97% to Rs 3,712 crore, led by higher contribution from fashion & lifestyle and consumer electronics verticals and growing operating leverage with strong like-for-like growth over the previous year across consumption baskets, the company said. Reliance Retail has 15,866 outlets as of June 30 this year.

“I am also happy with the progress of our consumer platforms. In retail business, our strong supply chain infrastructure and sourcing efficiency is helping us maintain competitive pricing for daily essentials, thereby insulating consumers from inflationary pressures…Jio is working towards expanding data availability for all Indians and I am pleased to see the positive trends in mobility and FTTH subscriber additions,” said Ambani. The consumer business (Jio and retail) accounted for 39% of RIL’s operating profit.

Operating profit of financial services and media businesses declined 18% and 76% to Rs 103 crore and Rs 46 crore, while that of oil & gas rose 243% to Rs 2,737 crore. RIL’s gross debt at the end of Q1FY23 was Rs 2.63 lakh crore, and it had Rs 2.05 lakh crore in cash and cash equivalents on its books.

[ad_2]

Source link