RBI lens on illegal digital loans, to bring out norms – Times of India

[ad_1]

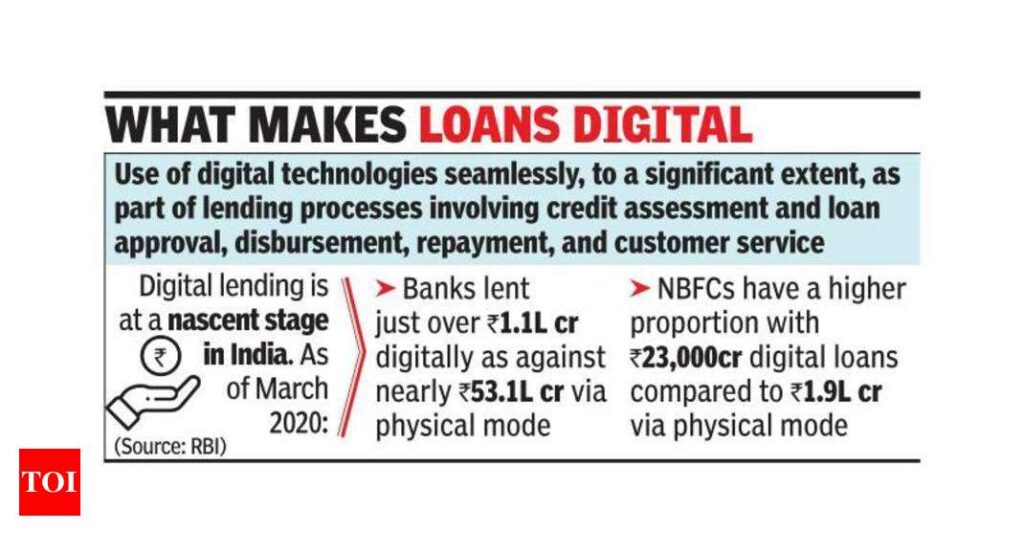

Mumbai: The RBI will soon come out with a regulatory architecture that will check irregularities in digital lending and improve governance among lenders. The central bank is also understood to be working closely with authorities to identify platforms that are not registered and are providing loans illegally.

“Very soon we should be coming out with a broad regulatory architecture that should address the challenges with regard to lending through digital platforms, many of which are unauthorised, unregistered and should I say illegal,” RBI governor Shaktikanta Das said. The governor was speaking at the iconic week celebration as part of the ‘Azadi ka Amrit Mahotsav’ to mark the 75th anniversary of India’s independence organised by the Central Board of Indirect Taxes and Customs (CBIC).

Das said that the central bank was observing a new generation of entrepreneurs who are the flagbearers of epochal changes. “At the RBI, we do recognise the role of existing and emerging businesses for economic progress. Long-term success of any business is directly linked to quality of governance, internal control systems and the robustness of its risk and the organisational culture,” said Das.

The RBI governor said that digital lending was the only area where the regulation was still a work in progress. “We have been pushing for improvement in governance structure of its regulated entities. In the last three years, we have issued norms for governance in banks, we have a new framework for NBFCs, microfinance institutions and we are working on a new framework for urban cooperative banks,” said Das. Addressing the media after the monetary policy committee meeting on Wednesday, Das said that the RBI had received the report of a committee constituted to look into digital lending and has received many comments on the report. “The details of the registered lending apps are there on the RBI website and whoever uses digital lending apps, I appeal to them to check whether they are regulated by the RBI. If they are registered with the RBI and there are irregularities, the RBI will take strict action,” said Das. The governor also indicated that the police would act against illegal lenders.

According to sources most of the apps against which there have been police complaints for harassment were illegal and not registered with the RBI. Banking sources said that many finance companies who were lending through fintechs were not providing details of the digital apps through which they lend on their website. This was despite the RBI insisting that both finance companies and the lending app display who the credit provider is.

“Very soon we should be coming out with a broad regulatory architecture that should address the challenges with regard to lending through digital platforms, many of which are unauthorised, unregistered and should I say illegal,” RBI governor Shaktikanta Das said. The governor was speaking at the iconic week celebration as part of the ‘Azadi ka Amrit Mahotsav’ to mark the 75th anniversary of India’s independence organised by the Central Board of Indirect Taxes and Customs (CBIC).

Das said that the central bank was observing a new generation of entrepreneurs who are the flagbearers of epochal changes. “At the RBI, we do recognise the role of existing and emerging businesses for economic progress. Long-term success of any business is directly linked to quality of governance, internal control systems and the robustness of its risk and the organisational culture,” said Das.

The RBI governor said that digital lending was the only area where the regulation was still a work in progress. “We have been pushing for improvement in governance structure of its regulated entities. In the last three years, we have issued norms for governance in banks, we have a new framework for NBFCs, microfinance institutions and we are working on a new framework for urban cooperative banks,” said Das. Addressing the media after the monetary policy committee meeting on Wednesday, Das said that the RBI had received the report of a committee constituted to look into digital lending and has received many comments on the report. “The details of the registered lending apps are there on the RBI website and whoever uses digital lending apps, I appeal to them to check whether they are regulated by the RBI. If they are registered with the RBI and there are irregularities, the RBI will take strict action,” said Das. The governor also indicated that the police would act against illegal lenders.

According to sources most of the apps against which there have been police complaints for harassment were illegal and not registered with the RBI. Banking sources said that many finance companies who were lending through fintechs were not providing details of the digital apps through which they lend on their website. This was despite the RBI insisting that both finance companies and the lending app display who the credit provider is.

[ad_2]

Source link