Complimentary IPL tkts to staff will attract GST – Times of India

[ad_1]

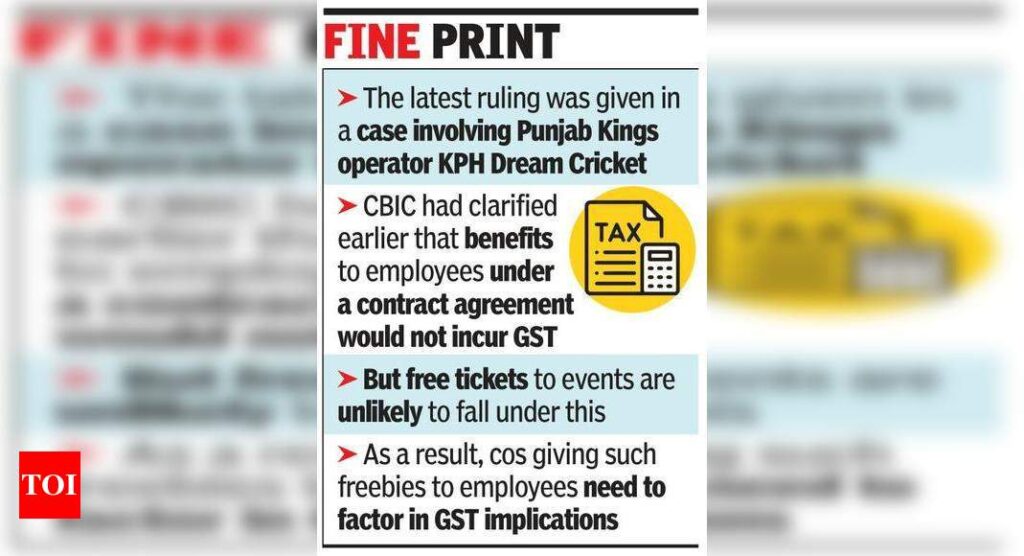

Mumbai: The Punjab bench of the Appellate Authority for Advance Rulings ruled recently that complimentary IPL tickets given to employees will attract goods & services tax (GST).

The ruling was given in the case of KPH Dream Cricket — which operates the IPL team Punjab Kings — and where complimentary tickets to IPL matches were given. It brings into focus the different implications of GST on free supplies made to related parties such as employees and unrelated parties like government officials & consultants.

In the backdrop of this ruling, Harpreet Singh, indirect-tax partner at KPMG-India, explains, “A complimentary supply to unrelated parties without any consideration — such as a goodwill gesture towards local officials — is not a ‘taxable supply’ and will be out of the ambit of GST. However, employees are regarded as related parties. If complimentary tickets are given to employees, GST will be attracted. In this case, against GST liability an input tax credit would be available.”

As reported by TOI, the Central Board of Excise and Customs (CBIC) recently clarified that a wide range of benefits to employees in terms of a contractual agreement will not be subject to GST. Free tickets to events are unlikely to fall within this nomenclature and GST implications need to be factored in.

“Watching sport events or other events as part of team activities is common in MNCs and other large companies. In all cases where the employer organisation provides free tickets to its employees, GST implications need to be borne in mind,” adds Singh.

Earlier, the Authority for Advance Rulings (AAR) had held that the activity of providing complimentary tickets without any consideration to ‘any person’ would be considered as a supply of services. In other words, GST would be applicable. This had led KPH Dream Cricket to approach the appellate bench.

The ruling was given in the case of KPH Dream Cricket — which operates the IPL team Punjab Kings — and where complimentary tickets to IPL matches were given. It brings into focus the different implications of GST on free supplies made to related parties such as employees and unrelated parties like government officials & consultants.

In the backdrop of this ruling, Harpreet Singh, indirect-tax partner at KPMG-India, explains, “A complimentary supply to unrelated parties without any consideration — such as a goodwill gesture towards local officials — is not a ‘taxable supply’ and will be out of the ambit of GST. However, employees are regarded as related parties. If complimentary tickets are given to employees, GST will be attracted. In this case, against GST liability an input tax credit would be available.”

As reported by TOI, the Central Board of Excise and Customs (CBIC) recently clarified that a wide range of benefits to employees in terms of a contractual agreement will not be subject to GST. Free tickets to events are unlikely to fall within this nomenclature and GST implications need to be factored in.

“Watching sport events or other events as part of team activities is common in MNCs and other large companies. In all cases where the employer organisation provides free tickets to its employees, GST implications need to be borne in mind,” adds Singh.

Earlier, the Authority for Advance Rulings (AAR) had held that the activity of providing complimentary tickets without any consideration to ‘any person’ would be considered as a supply of services. In other words, GST would be applicable. This had led KPH Dream Cricket to approach the appellate bench.

[ad_2]

Source link