We’ve been scarred by Covid pandemic, task ahead is to restore growth: RBI governor – Times of India

[ad_1]

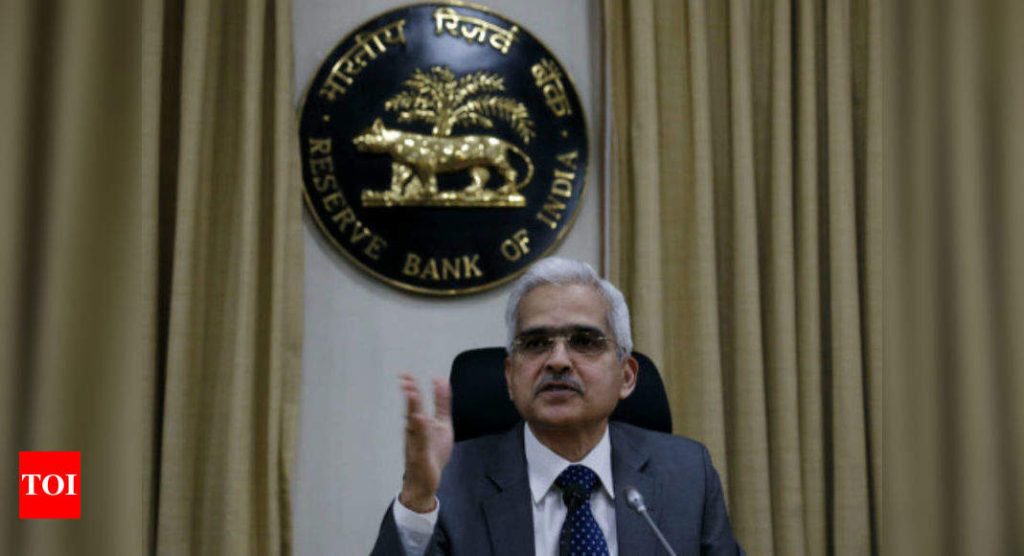

NEW DELHI: RBI governor Shaktikanta Das on Monday said that the economic prospects have been scarred by the Covid-19 pandemic and the task ahead is to restore growth and livelihood. “Financial stability is a precondition for supporting this (growth) mission,” he added.

He also said that expansion in government’s market borrowing programme following coronavirus has imposed additional pressures on banks.

The RBI governor, in his foreword to the bi-annual Financial Stability Report (FSR), mentioned that the pandemic can result in balance sheet impairments and capital shortfalls in banks as regulatory reliefs are rolled back.

The RBI had declared a six-month moratorium which ended in August and later announced a one-time loan recast package to help borrowers. Many banks, especially the private sector ones, have already raised safety capital in the early days of the pandemic.

Das stated that available accounting numbers obscure true recognition of stress at banks and lenders should raise capital along with altering business models.

Das listed out that maintaining banking sector’s health remains a policy priority for the central bank.

Here are the highlights from RBI’s report:

* In the initial phase of the Covid pandemic, policy actions were geared towards restoring normal functioning and mitigating stress; the focus is now being oriented towards supporting the recovery and preserving the solvency of businesses and households.

* Positive news on vaccine development has underpinned optimism on the outlook, though it is marred by second wave of the virus including more virulent strains.

* Policy measures by the regulators and the government have ensured the smooth functioning of domestic markets and financial institutions; managing market volatility amidst rising spillovers has become challenging especially when the movements in certain segments of the financial markets are not in sync with developments in the real sector.

* Bank credit growth has remained subdued, with the moderation being broad-based across bank groups.

* Performance parameters of banks have improved significantly, aided by regulatory dispensations extended in response to the Covid pandemic.

* The capital to risk-weighted assets ratio (CRAR) of scheduled commercial banks (SCBs) improved to 15.8 per cent in September 2020 from 14.7 per cent in March 2020, while their gross non-performing asset (GNPA) ratio declined to 7.5 per cent from 8.4 per cent, and the provision coverage ratio (PCR) improved to 72.4 per cent from 66.2 per cent over this period.

* Macro stress tests incorporating the first advance estimates of gross domestic product (GDP) for 2020-21 released on January 7, 2021 indicate that the GNPA ratio of all SCBs may increase from 7.5 per cent in September 2020 to 13.5 per cent by September 2021 under the baseline scenario; the ratio may escalate to 14.8 per cent under a severe stress scenario. This highlights the need for proactive building up of adequate capital to withstand possible asset quality deterioration.

* Network analysis reveals that total bilateral exposures among entities in the financial system increased marginally during the quarter-ended September 2020. With the inter-bank market continuing to shrink and with better capitalisation of banks, the contagion risk to the banking system under various scenarios declined as compared to March 2020.

(With inputs from agencies)

He also said that expansion in government’s market borrowing programme following coronavirus has imposed additional pressures on banks.

The RBI governor, in his foreword to the bi-annual Financial Stability Report (FSR), mentioned that the pandemic can result in balance sheet impairments and capital shortfalls in banks as regulatory reliefs are rolled back.

The RBI had declared a six-month moratorium which ended in August and later announced a one-time loan recast package to help borrowers. Many banks, especially the private sector ones, have already raised safety capital in the early days of the pandemic.

Das stated that available accounting numbers obscure true recognition of stress at banks and lenders should raise capital along with altering business models.

Das listed out that maintaining banking sector’s health remains a policy priority for the central bank.

Here are the highlights from RBI’s report:

* In the initial phase of the Covid pandemic, policy actions were geared towards restoring normal functioning and mitigating stress; the focus is now being oriented towards supporting the recovery and preserving the solvency of businesses and households.

* Positive news on vaccine development has underpinned optimism on the outlook, though it is marred by second wave of the virus including more virulent strains.

* Policy measures by the regulators and the government have ensured the smooth functioning of domestic markets and financial institutions; managing market volatility amidst rising spillovers has become challenging especially when the movements in certain segments of the financial markets are not in sync with developments in the real sector.

* Bank credit growth has remained subdued, with the moderation being broad-based across bank groups.

* Performance parameters of banks have improved significantly, aided by regulatory dispensations extended in response to the Covid pandemic.

* The capital to risk-weighted assets ratio (CRAR) of scheduled commercial banks (SCBs) improved to 15.8 per cent in September 2020 from 14.7 per cent in March 2020, while their gross non-performing asset (GNPA) ratio declined to 7.5 per cent from 8.4 per cent, and the provision coverage ratio (PCR) improved to 72.4 per cent from 66.2 per cent over this period.

* Macro stress tests incorporating the first advance estimates of gross domestic product (GDP) for 2020-21 released on January 7, 2021 indicate that the GNPA ratio of all SCBs may increase from 7.5 per cent in September 2020 to 13.5 per cent by September 2021 under the baseline scenario; the ratio may escalate to 14.8 per cent under a severe stress scenario. This highlights the need for proactive building up of adequate capital to withstand possible asset quality deterioration.

* Network analysis reveals that total bilateral exposures among entities in the financial system increased marginally during the quarter-ended September 2020. With the inter-bank market continuing to shrink and with better capitalisation of banks, the contagion risk to the banking system under various scenarios declined as compared to March 2020.

(With inputs from agencies)

[ad_2]

Source link