Surprise recovery in tax collections: Tarun Bajaj – Times of India

[ad_1]

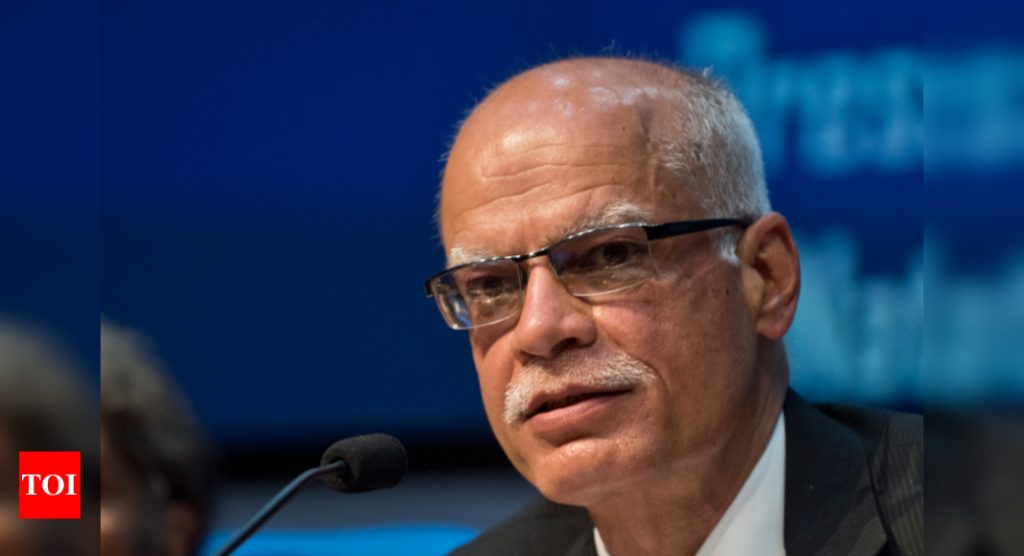

NEW DELHI: Tarun Bajaj is handling two crucial portfolios — economic affairs and revenue — at a time when the economy is recovering from the Covid shock. In an interview, the top finance ministry official told TOI that revenue collections have seen a surprise recovery, while the government has pushed spending during the last two months. Excerpts:

Will you see tax collections scale revised estimates for 2020-21?

Figures are still coming in. Data for February and March have been a very pleasant surprise for us. The numbers are definitely more than what we had expected at the time of the revised estimates. I am impressed by the resilience of the corporate sector that the reduction in corporate tax would be very small. Gross collection of direct taxes would be lower by about 2-3% as compared to the last year (2019-20). It will be higher than revised estimates. We have also pushed refunds this year, which have crossed Rs 2.5 lakh crore. We wanted to clear more than 90% of the refunds, if they are not cleared, it would be because of bank holidays. On indirect taxes, we have created a record on GST collection.

What do you attribute this robust collection to?

One is recovery. We didn’t expect the recovery to happen at this pace. We thought the first quarter has been lost, we thought they won’t be able to recover the lost grounds in the remaining nine months. I admire the resilience of the corporate sector. They have been able to tighten their belts, have had good revenues.

You also seem to have pushed expenditure. Will you end the year higher than revised estimates?

We have decided to push more expenditure. We are releasing more funds to the states. We have released an extra Rs 45,000 crore to states over and above the revised estimates.

How does the surge in Covid cases impact the next quarter outlook?

If I say I am not worried, it will not be correct. Fortunately, there is an experience in the country to handle the pandemic and also that states are not going for massive lockdowns. We are now trying to push vaccines — two vaccines are out, five more candidates are in the offing. So, unlike last year, this time we have better health infrastructure and we have got vaccines. There may be some impact on people, in terms of people going to restaurants, etc, but overall, we should be able to pass this.

What will be the strategy for the new financial year?

It will be a two-pronged strategy. We will make it easier for the honest taxpayer. On GST, we have about a dozen things lined up. These will help small taxpayers and honest taxpayers. The second side is that we are getting a lot of information through technology. So, if we catch an unscrupulous person A, we know why we are catching him. We have evidence-based information and we have a targeted approach without over-reach. The system that Dr Ajay Bhushan Pandey built up, we are reaping its benefits. We have arrested around 400 people so far, including a dozen chartered accountants. We are also linking indirect and direct taxes (data sharing).

There are suggestions that fuel should be brought under GST.

Is it also time to start the process of GST rate rationalisation and initiate other reforms?

There are a dozen items and we are going to do those reforms. That is an issue that is pending, which will be taken up by the GST Council. On fuel, the FM has already answered that.

Will you see tax collections scale revised estimates for 2020-21?

Figures are still coming in. Data for February and March have been a very pleasant surprise for us. The numbers are definitely more than what we had expected at the time of the revised estimates. I am impressed by the resilience of the corporate sector that the reduction in corporate tax would be very small. Gross collection of direct taxes would be lower by about 2-3% as compared to the last year (2019-20). It will be higher than revised estimates. We have also pushed refunds this year, which have crossed Rs 2.5 lakh crore. We wanted to clear more than 90% of the refunds, if they are not cleared, it would be because of bank holidays. On indirect taxes, we have created a record on GST collection.

What do you attribute this robust collection to?

One is recovery. We didn’t expect the recovery to happen at this pace. We thought the first quarter has been lost, we thought they won’t be able to recover the lost grounds in the remaining nine months. I admire the resilience of the corporate sector. They have been able to tighten their belts, have had good revenues.

You also seem to have pushed expenditure. Will you end the year higher than revised estimates?

We have decided to push more expenditure. We are releasing more funds to the states. We have released an extra Rs 45,000 crore to states over and above the revised estimates.

How does the surge in Covid cases impact the next quarter outlook?

If I say I am not worried, it will not be correct. Fortunately, there is an experience in the country to handle the pandemic and also that states are not going for massive lockdowns. We are now trying to push vaccines — two vaccines are out, five more candidates are in the offing. So, unlike last year, this time we have better health infrastructure and we have got vaccines. There may be some impact on people, in terms of people going to restaurants, etc, but overall, we should be able to pass this.

What will be the strategy for the new financial year?

It will be a two-pronged strategy. We will make it easier for the honest taxpayer. On GST, we have about a dozen things lined up. These will help small taxpayers and honest taxpayers. The second side is that we are getting a lot of information through technology. So, if we catch an unscrupulous person A, we know why we are catching him. We have evidence-based information and we have a targeted approach without over-reach. The system that Dr Ajay Bhushan Pandey built up, we are reaping its benefits. We have arrested around 400 people so far, including a dozen chartered accountants. We are also linking indirect and direct taxes (data sharing).

There are suggestions that fuel should be brought under GST.

Is it also time to start the process of GST rate rationalisation and initiate other reforms?

There are a dozen items and we are going to do those reforms. That is an issue that is pending, which will be taken up by the GST Council. On fuel, the FM has already answered that.

[ad_2]

Source link