Stock bet or safety in gold? What should be your pick – Times of India

[ad_1]

However, a runaway stock market at stretched valuations is again forcing cautious investors into debt schemes, while gold prices are stable (along with a steady currency). What should be your strategy for 2021?

Fixed deposits (FDs)

The government-RBI’s move to support the economy by ensuring ample funds, has succeeded in keeping interest rates low, rising inflation notwithstanding. If the govt maintains FY22 market borrowing under check, FDs may be a safe haven, but offering a low rate of interest.

Tip: In addition to bank FDs, senior citizens may look at safer mutual fund schemes for a slightly higher return.

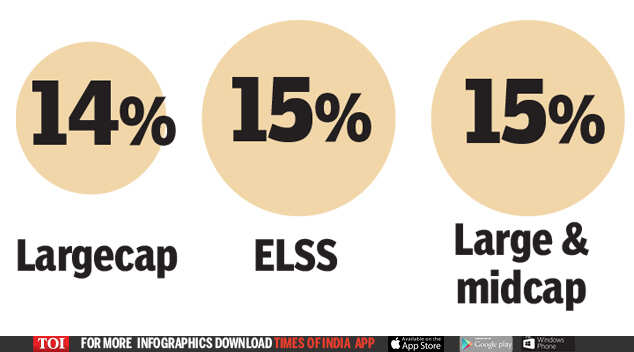

Mutual funds (MFs)

Most MFs have given low double-digit return while inflation was in mid-single digits. Sectoral funds like IT and pharma are expected to be subdued in 2021. If RBI keeps yields under check, debt funds, after the Franklin Templeton MF scare, would get a chance to redeem themselves in 2021.

(MF returns since January; Source: Value Research)

Tip: Continue with your SIPs.

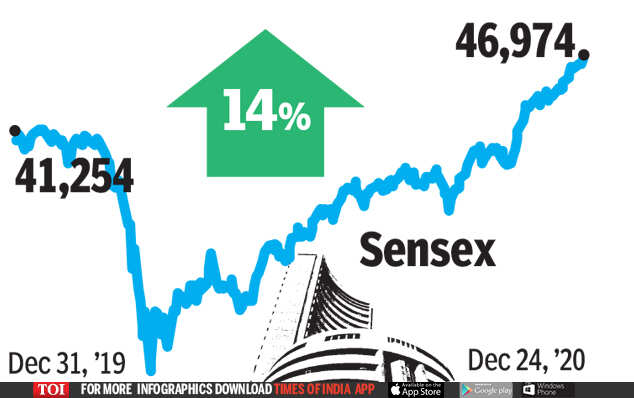

Stocks

The sensex has given an incredible 81% return from March lows in 2020. Analysts expect it to rise another 10-15% in 2021 to breach the 50k peak.

Tip: Be on your guard as large IPOs may suck money out of the system and foreign funds may turn cautious on Indian shares. One of the two possibilities could trigger a slide in the market.

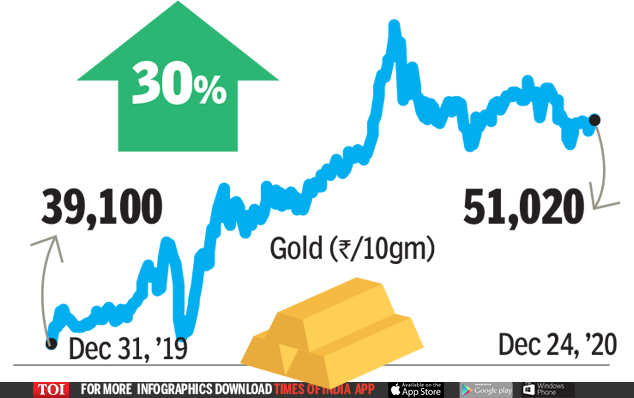

Gold

After a rally in early 2020, gold prices receded as investors turned to stocks and real estate. If stocks dip, gold can again race past the $2,000/oz mark. In India, it soared nearly 30% to cross the Rs 50k/10gm mark. Rupee-dollar rate and stocks will determine its next pricing level.

Tip: If markets turn volatile, bet on this precious metal.

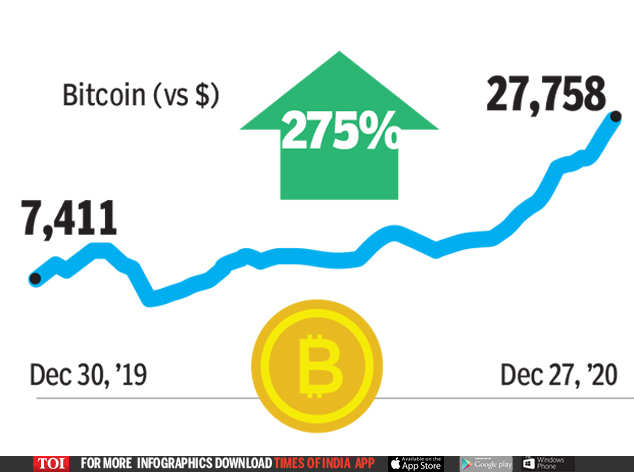

Bitcoin

Its explosive run will continue till the dollar remains weak. Although it has given over three times return in 2020, its volatile nature is a major worry.

Tip: Absence of any underlying asset makes bitcoin extremely risky. Still looking to invest? Need to open an account with a bitcoin exchange.

[ad_2]

Source link