Sensex scales 318 points to finish at record high; Nifty ends at 16,364 – Times of India

[ad_1]

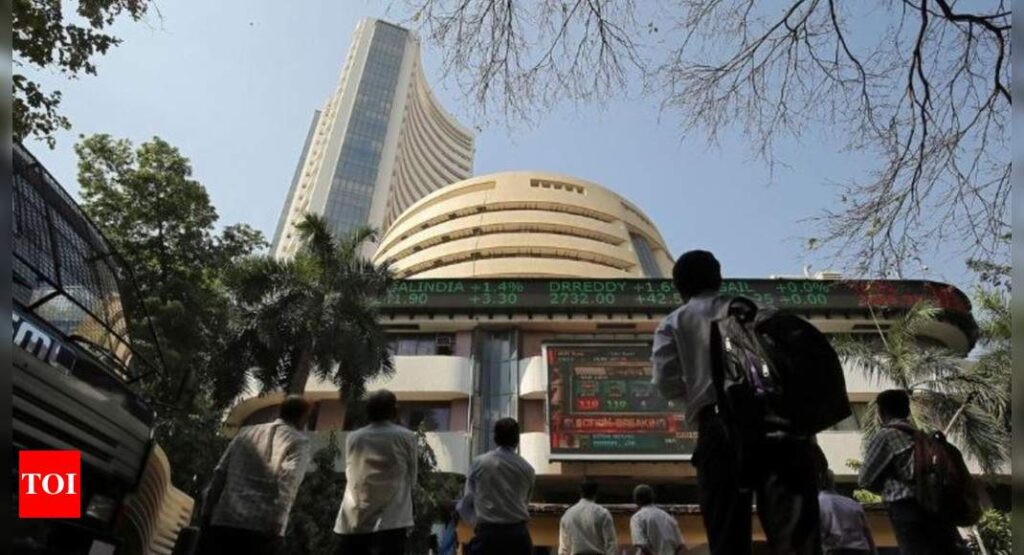

NEW DELHI: Equity indices scaled fresh highs on Thursday with the benchmark BSE sensex rising over 300 points led by gains in realty, IT and banking stocks amid positive global cues.

After scaling an intra-day high of 54,874, the 30-share BSE index jumped 318 points or 0.58 per cent to close at a new record peak of 54,844. While, the broader NSE Nifty settled 82 points or 0.5 per cent higher at a fresh high of 16,364.

Top gainers in the sensex pack included PowerGrid, Tech Mahindra, HCL Tech, L&T, Titan, NTPC and ICICI Bank with their shares rising as much as 6.05 per cent.

Whereas, Dr Reddy, M&M, IndusInd Bank, Axis Bank and Maruti were the major losers falling up to 0.77 per cent.

On the NSE platform, sub-indices Nifty Media, IT, Realty, PSU Bank gained as much as 2.28 per cent.

According to experts, a strong overnight close on Wall Street and easing inflation worries are driving domestic markets, but subdued Asian stocks have capped gains.

“Global equity markets have positive news from the US inflation data for July which has come at 0.5 per cent month-on-month. This is slightly lower than expected and confirms the Fed thesis that inflation is transitory,” said V K Vijayakumar, chief Investment Strategist at Geojit Financial Services told news agency PTI.

The positive response of Dow and S&P to the inflation numbers and the decline in the dollar index will strengthen the bulls.

Investors are also looking forward to the the consumer price inflation data for July, scheduled to be released later in the day.

On the global front, Asian shares dipped as fears about the spread of the Delta variant of the coronavirus weighed on sentiment, even as tame US inflation eased fears of a Federal Reserve rate hike.

Meanwhile, foreign institutional investors (FIIs) were net buyers in the capital market as they purchased shares worth Rs 238.14 crore on Wednesday, as per provisional exchange data.

(With inputs from agencies)

After scaling an intra-day high of 54,874, the 30-share BSE index jumped 318 points or 0.58 per cent to close at a new record peak of 54,844. While, the broader NSE Nifty settled 82 points or 0.5 per cent higher at a fresh high of 16,364.

Top gainers in the sensex pack included PowerGrid, Tech Mahindra, HCL Tech, L&T, Titan, NTPC and ICICI Bank with their shares rising as much as 6.05 per cent.

Whereas, Dr Reddy, M&M, IndusInd Bank, Axis Bank and Maruti were the major losers falling up to 0.77 per cent.

On the NSE platform, sub-indices Nifty Media, IT, Realty, PSU Bank gained as much as 2.28 per cent.

According to experts, a strong overnight close on Wall Street and easing inflation worries are driving domestic markets, but subdued Asian stocks have capped gains.

“Global equity markets have positive news from the US inflation data for July which has come at 0.5 per cent month-on-month. This is slightly lower than expected and confirms the Fed thesis that inflation is transitory,” said V K Vijayakumar, chief Investment Strategist at Geojit Financial Services told news agency PTI.

The positive response of Dow and S&P to the inflation numbers and the decline in the dollar index will strengthen the bulls.

Investors are also looking forward to the the consumer price inflation data for July, scheduled to be released later in the day.

On the global front, Asian shares dipped as fears about the spread of the Delta variant of the coronavirus weighed on sentiment, even as tame US inflation eased fears of a Federal Reserve rate hike.

Meanwhile, foreign institutional investors (FIIs) were net buyers in the capital market as they purchased shares worth Rs 238.14 crore on Wednesday, as per provisional exchange data.

(With inputs from agencies)

[ad_2]

Source link