Sebi looks to do away with promoter concept – Times of India

[ad_1]

MUMBAI: With the definition of a promoter undergoing a change as a large number of private equity and venture fund-led companies are getting listed on the bourses, Sebi has decided to do away with this traditional concept.

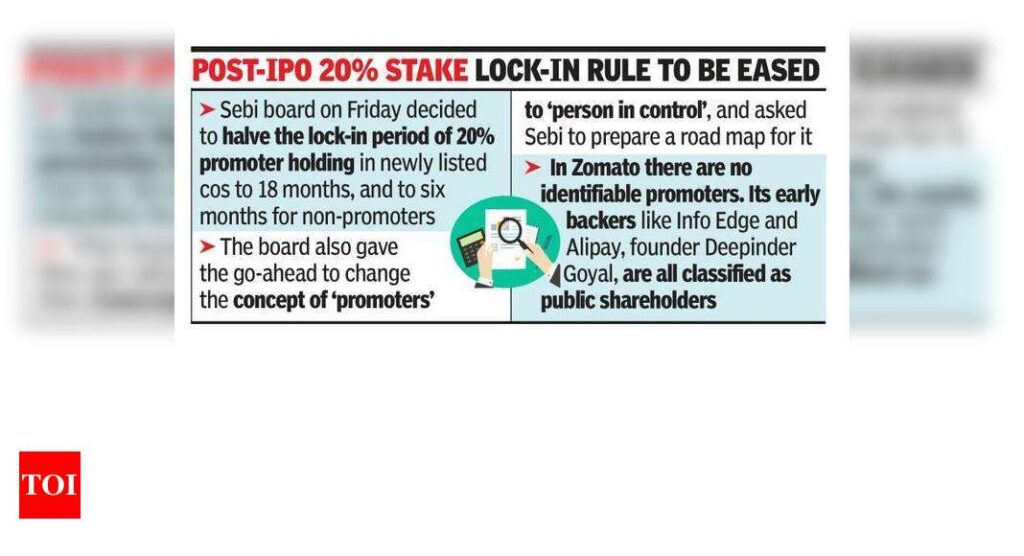

The Sebi board on Friday gave its nod to start the process of changing the concept of ‘promoters’ to ‘person in control’ or ‘controlling shareholders’ and asked the regulator to prepare a road map in consultation with their counterparts. “In recent years, number of businesses and new age companies with diversified shareholding and professional management that are coming into the listed space are non-family owned and/or do not have a distinctly identifiable promoter group,” Sebi said.

For instance, in the recently listed Zomato, there are no identifiable promoters, NSE data showed. Its early backers like Info Edge and Alipay (an arm of Alibaba of China), Deepinder Goyal, the founder as well as Uber BV, that sold its food delivery business to it recently, are all listed as public shareholders. Traditionally, most of the bluechips like Reliance Industries, TCS, HDFC Bank and several others have promoters. The exceptions include HDFC, ICICI Bank, ITC and L&T.

The board also decided to halve the 20% lock-in of promoter holding in newly listed companies to 18 months from three years and for non-promoters for six months from one year. These will be subject to some conditions relating to use of funds raised through the IPO, Sebi said.

Industry experts say both the decisions are to keep market regulations in tune with the emerging shareholding scenario in the country. According to Sandeep Parekh, a securities lawyer and former executive director with Sebi, the concept of promoter is a rigid one with “almost no international parallel”. “Sebi’s decision to move to the concept of ‘person in control’ is a more realistic, fluid and accurate portrayal of who actually controls the company,” Parekh said.

Securities lawyers also feel that the reduction in lock-in of holdings is a forward-looking step. “Private equity investors will welcome the reduction of the post-IPO lock-in period as they can get a timely exit,” Anand Lakra, partner, J Sagar Associates, said. According to Parekh, this decision also has the potential to increase liquidity in the market, “as more shares become available for trading”. Lakra also feels that Sebi could use this opportunity — the move to change from promoter to person-in-control — to re-consider the definition of control itself. To facilitate the government’s ‘ease of doing business’ objective, Sebi on Friday also scrapped the requirement of disclosing post-facto nod for acquisitions between 2-5% shareholding in market infrastructure institutions. “The stock exchanges, clearing corporations and depositories shall put in place appropriate mechanism to ensure compliance with fit and proper criteria,” Sebi said.

Sebi also merged two regulations — Issue of Sweat Equity Regulations, and Share Based Employee Benefits Regulations — into a new one called Sebi (Share Based Employee Benefits and Sweat Equity) Regulations, 2021.

The Sebi board on Friday gave its nod to start the process of changing the concept of ‘promoters’ to ‘person in control’ or ‘controlling shareholders’ and asked the regulator to prepare a road map in consultation with their counterparts. “In recent years, number of businesses and new age companies with diversified shareholding and professional management that are coming into the listed space are non-family owned and/or do not have a distinctly identifiable promoter group,” Sebi said.

For instance, in the recently listed Zomato, there are no identifiable promoters, NSE data showed. Its early backers like Info Edge and Alipay (an arm of Alibaba of China), Deepinder Goyal, the founder as well as Uber BV, that sold its food delivery business to it recently, are all listed as public shareholders. Traditionally, most of the bluechips like Reliance Industries, TCS, HDFC Bank and several others have promoters. The exceptions include HDFC, ICICI Bank, ITC and L&T.

The board also decided to halve the 20% lock-in of promoter holding in newly listed companies to 18 months from three years and for non-promoters for six months from one year. These will be subject to some conditions relating to use of funds raised through the IPO, Sebi said.

Industry experts say both the decisions are to keep market regulations in tune with the emerging shareholding scenario in the country. According to Sandeep Parekh, a securities lawyer and former executive director with Sebi, the concept of promoter is a rigid one with “almost no international parallel”. “Sebi’s decision to move to the concept of ‘person in control’ is a more realistic, fluid and accurate portrayal of who actually controls the company,” Parekh said.

Securities lawyers also feel that the reduction in lock-in of holdings is a forward-looking step. “Private equity investors will welcome the reduction of the post-IPO lock-in period as they can get a timely exit,” Anand Lakra, partner, J Sagar Associates, said. According to Parekh, this decision also has the potential to increase liquidity in the market, “as more shares become available for trading”. Lakra also feels that Sebi could use this opportunity — the move to change from promoter to person-in-control — to re-consider the definition of control itself. To facilitate the government’s ‘ease of doing business’ objective, Sebi on Friday also scrapped the requirement of disclosing post-facto nod for acquisitions between 2-5% shareholding in market infrastructure institutions. “The stock exchanges, clearing corporations and depositories shall put in place appropriate mechanism to ensure compliance with fit and proper criteria,” Sebi said.

Sebi also merged two regulations — Issue of Sweat Equity Regulations, and Share Based Employee Benefits Regulations — into a new one called Sebi (Share Based Employee Benefits and Sweat Equity) Regulations, 2021.

[ad_2]

Source link