RBI governor warns of high asset prices – Times of India

[ad_1]

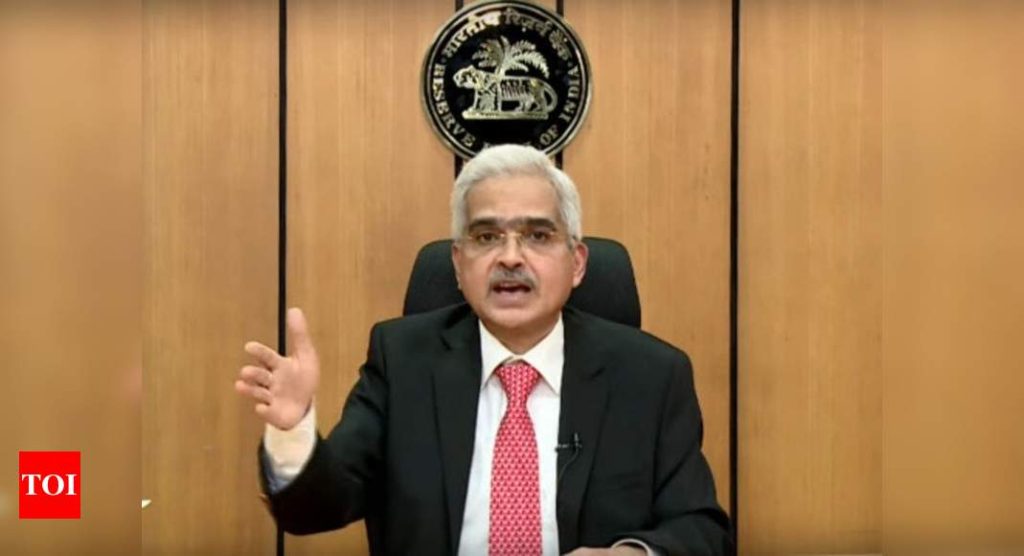

MUMBAI: Reserve Bank of India (RBI) governor Shaktikanta Das on Monday warned that there is a growing disconnect between certain segments of financial markets and the real economy, and stretched valuations pose a risk to financial stability.

The governor’s warnings on inflated valuations come at a time when equity prices are surging by the day and the sensex is inching towards the 50,000 mark, nearly double the closing low of 25,981 it had touched on March 23 in the wake of the Covid outbreak last year. The sensex’s rise has been despite grim forecasts of the economy shrinking by over 7.5% during the current fiscal.

The governor’s warnings are part of the foreword to the Financial Stability Report released by the central bank on Monday. While the governor had made the same observation of a disconnect between some financial markets and the real manufacturing sector, this time he has highlighted the risk to financial stability. On the positive side, the governor said that digital technologies have been identified as a bright spot in India’s economic prospects.

“A multi-speed recovery is struggling to gain traction, infusing hope, reinforced by positive news on vaccine development. Nonetheless, the second wave of infections and new mutations of the virus have spread heightened uncertainty, threatening to stall the fragile recovery,” Das said.

Describing maintaining the health of banks a policy priority, Das said that stress in banks’ balance sheets has been hidden because of congenial liquidity and financing conditions, which have shored up their financial parameters. “But it is recognised that the available accounting numbers obscure a true recognition of stress,” Das said.

He pointed out that the banking system had been hit by the crisis when it had improved in strength. Yet, the pandemic threatened to impair balance sheets and trigger capital shortfalls, especially as regulatory reliefs are rolled back, he said. “In addition, banks will be called to meet the funding requirements of the economy as it traces a revival from the pandemic. Consequently, maintaining the health of the banking sector remains a policy priority and preservation of the stability of the financial system is an overarching goal,” said Das.

According to the governor, the government’s decision to borrow more in the wake of revenue shortfalls have added to the pressure on banks. The governor urged all stakeholders to make more investments for building robust IT platforms and technologies for operational purposes as well as for fortifying public confidence in digital banking.

The governor’s comments on increasing IT investment comes in the wake of the central bank ban on HDFC Bank launching new digital products following regular outages on its online banking platform. Since then, a couple of other banks have faced disruptions in their online banking.

The RBI has indicated that it will take serious note of such disruptions given that digital is becoming a primary channel for most customers to avail banking services.

According to the governor, the government’s decision to borrow more in the wake of revenue shortfalls have added to the pressure on banks. The governor urged all stakeholders to make more investments for building robust IT platforms and technologies for operational purposes as well as for fortifying public confidence in digital banking.

The governor’s warnings on inflated valuations come at a time when equity prices are surging by the day and the sensex is inching towards the 50,000 mark, nearly double the closing low of 25,981 it had touched on March 23 in the wake of the Covid outbreak last year. The sensex’s rise has been despite grim forecasts of the economy shrinking by over 7.5% during the current fiscal.

The governor’s warnings are part of the foreword to the Financial Stability Report released by the central bank on Monday. While the governor had made the same observation of a disconnect between some financial markets and the real manufacturing sector, this time he has highlighted the risk to financial stability. On the positive side, the governor said that digital technologies have been identified as a bright spot in India’s economic prospects.

“A multi-speed recovery is struggling to gain traction, infusing hope, reinforced by positive news on vaccine development. Nonetheless, the second wave of infections and new mutations of the virus have spread heightened uncertainty, threatening to stall the fragile recovery,” Das said.

Describing maintaining the health of banks a policy priority, Das said that stress in banks’ balance sheets has been hidden because of congenial liquidity and financing conditions, which have shored up their financial parameters. “But it is recognised that the available accounting numbers obscure a true recognition of stress,” Das said.

He pointed out that the banking system had been hit by the crisis when it had improved in strength. Yet, the pandemic threatened to impair balance sheets and trigger capital shortfalls, especially as regulatory reliefs are rolled back, he said. “In addition, banks will be called to meet the funding requirements of the economy as it traces a revival from the pandemic. Consequently, maintaining the health of the banking sector remains a policy priority and preservation of the stability of the financial system is an overarching goal,” said Das.

According to the governor, the government’s decision to borrow more in the wake of revenue shortfalls have added to the pressure on banks. The governor urged all stakeholders to make more investments for building robust IT platforms and technologies for operational purposes as well as for fortifying public confidence in digital banking.

The governor’s comments on increasing IT investment comes in the wake of the central bank ban on HDFC Bank launching new digital products following regular outages on its online banking platform. Since then, a couple of other banks have faced disruptions in their online banking.

The RBI has indicated that it will take serious note of such disruptions given that digital is becoming a primary channel for most customers to avail banking services.

According to the governor, the government’s decision to borrow more in the wake of revenue shortfalls have added to the pressure on banks. The governor urged all stakeholders to make more investments for building robust IT platforms and technologies for operational purposes as well as for fortifying public confidence in digital banking.

[ad_2]

Source link