Need same inflation target for 5 more years: RBI – Times of India

[ad_1]

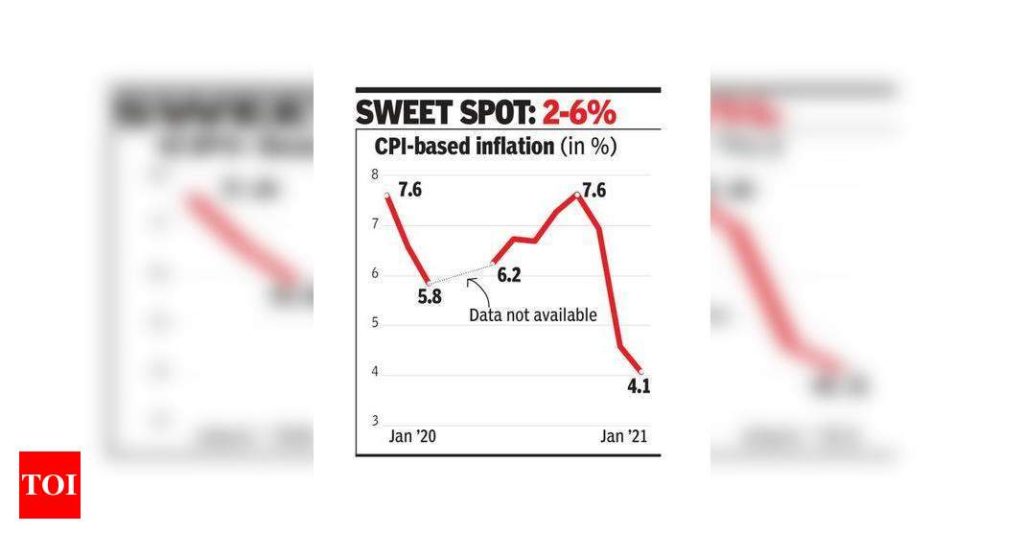

Mumbai: The Reserve Bank of India has said that the current inflation target of 2-6% should continue for the next five years as consumers still have expectations of an elevated inflation. The central bank’s statement comes at a time when some commentators have said that it should be more tolerant of inflation in the wake of the economic crisis brought about by the pandemic.

“The international experience suggests that inflation-targeting emerging market economies have either lowered their inflation targets or kept their targets unchanged over time. In India, however, the repetitive incidence of supply shocks, still elevated inflation expectations and projection errors necessitate persevering with the current numerical framework for the target and tolerance band for inflation for the next five years,” the RBI said in its report on currency and finance.

The central bank has also called for flexibility in the target to deal with any sudden changes. “It is important to recognise that while setting a single target/tolerance band for the next five years, structural changes that may materialise or the type of shocks that may hit the economy are difficult to anticipate fully. Hence, flexibility must be built into the framework, without undermining the discipline of the inflation target,” the RBI said in the report.

The central bank adopted a flexible inflation targeting framework in 2016 under Urjit Patel, when it also shifted to the monetary policy committee (MPC) framework for deciding on interest rates. In terms of the legislation, the inflation target must be reviewed every five years. Despite the volatility in prices, inflation-targeting is seen to be a success as trend inflation has eased to 4.3% in 2020.

Lower inflation enables the RBI to keep interest rates low too and thus encourage investments. It also preserves the value of the domestic currency and therefore supports the domestic currency. According to the RBI, the inflation target needs to be close to the trend rate.

“There is an influential view that setting the target above the trend could increase inflation and its volatility, undermining the confidence of firms and households to undertake and execute long-term plans, squandering the credibility of the central bank, destabilising inflation expectations and raising risk premiums in asset markets,” the central bank said. On the other hand, a target fixed much below the trend could produce a deflationary bias in the economy and hurt growth.

Some experts have argued that the RBI should differentiate between inflation caused by demand and supply side constraints. However, the central bank has always held that irrespective of the cause, inflation would have implications for financial markets and the RBI could respond only through its monetary policy.

“The international experience suggests that inflation-targeting emerging market economies have either lowered their inflation targets or kept their targets unchanged over time. In India, however, the repetitive incidence of supply shocks, still elevated inflation expectations and projection errors necessitate persevering with the current numerical framework for the target and tolerance band for inflation for the next five years,” the RBI said in its report on currency and finance.

The central bank has also called for flexibility in the target to deal with any sudden changes. “It is important to recognise that while setting a single target/tolerance band for the next five years, structural changes that may materialise or the type of shocks that may hit the economy are difficult to anticipate fully. Hence, flexibility must be built into the framework, without undermining the discipline of the inflation target,” the RBI said in the report.

The central bank adopted a flexible inflation targeting framework in 2016 under Urjit Patel, when it also shifted to the monetary policy committee (MPC) framework for deciding on interest rates. In terms of the legislation, the inflation target must be reviewed every five years. Despite the volatility in prices, inflation-targeting is seen to be a success as trend inflation has eased to 4.3% in 2020.

Lower inflation enables the RBI to keep interest rates low too and thus encourage investments. It also preserves the value of the domestic currency and therefore supports the domestic currency. According to the RBI, the inflation target needs to be close to the trend rate.

“There is an influential view that setting the target above the trend could increase inflation and its volatility, undermining the confidence of firms and households to undertake and execute long-term plans, squandering the credibility of the central bank, destabilising inflation expectations and raising risk premiums in asset markets,” the central bank said. On the other hand, a target fixed much below the trend could produce a deflationary bias in the economy and hurt growth.

Some experts have argued that the RBI should differentiate between inflation caused by demand and supply side constraints. However, the central bank has always held that irrespective of the cause, inflation would have implications for financial markets and the RBI could respond only through its monetary policy.

[ad_2]

Source link