Jan Dhan: Women save more than men – Times of India

[ad_1]

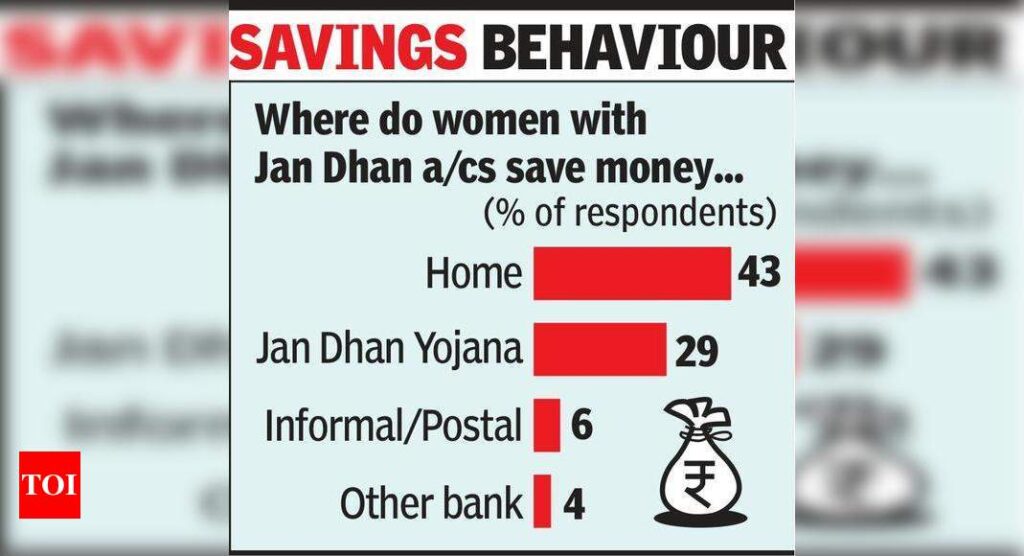

Mumbai: Average balances maintained by women in Jan Dhan Yojana accounts are 30% more than men, according to an industry report. The study, published by Women’s World Banking and Bank of Baroda, estimates that by serving 10 crore low-income women, public sector banks could attract Rs 25,000 crore in deposits and empower 40 crore low-income Indians.

The report recommends that banks design products for women that allows them to make small deposits and overcome inhibiting factors. To get them to use the accounts, it asks banks to promote awareness and nudge customers. It has called for transforming business correspondents from human ATMs into relationship managers offering rural women all financial products. Finally, it calls upon banks to disaggregate their Jan Dhan account data according to gender.

“We are blessed to have a platform like the Jan Dhan Yojana accounts, which can be the world’s largest women-empowerment opportunity,” said Women’s World Banking executive VP (Asia) Sriraman Jagannathan. According to him, in any other country, a women-empowerment programme would have to be run using a pilot programme. In India, most women already have the Jan Dhan accounts.

Bank of Baroda MD & CEO Sanjiv Chadha said, “A good percentage of women, especially those belonging to the low-income group, still shy away from realising the full potential of their bank accounts. Rather, they still view it only as a channel to receive and withdraw cash. And, therein lies an unutilised opportunity and an untapped potential from a banking perspective.”

A pilot run by Bank of Baroda on a women-specific savings account linked to Jan Dhan Yojana was highly successful. The basic bank account, without any charges or minimum balance requirement, drew a large number of women after the government announced its decision to transfer Rs 500 a month during the pandemic year to women’s accounts.

“This groundswell of women accounts has made her own agency possible. Banks are now able to get a view on her savings and cash flows and offer loans and other products and services,” said Jagannathan. He added that retirement products are crucial for women as they generally outlive men but do not have financial assets.

The report recommends that banks design products for women that allows them to make small deposits and overcome inhibiting factors. To get them to use the accounts, it asks banks to promote awareness and nudge customers. It has called for transforming business correspondents from human ATMs into relationship managers offering rural women all financial products. Finally, it calls upon banks to disaggregate their Jan Dhan account data according to gender.

“We are blessed to have a platform like the Jan Dhan Yojana accounts, which can be the world’s largest women-empowerment opportunity,” said Women’s World Banking executive VP (Asia) Sriraman Jagannathan. According to him, in any other country, a women-empowerment programme would have to be run using a pilot programme. In India, most women already have the Jan Dhan accounts.

Bank of Baroda MD & CEO Sanjiv Chadha said, “A good percentage of women, especially those belonging to the low-income group, still shy away from realising the full potential of their bank accounts. Rather, they still view it only as a channel to receive and withdraw cash. And, therein lies an unutilised opportunity and an untapped potential from a banking perspective.”

A pilot run by Bank of Baroda on a women-specific savings account linked to Jan Dhan Yojana was highly successful. The basic bank account, without any charges or minimum balance requirement, drew a large number of women after the government announced its decision to transfer Rs 500 a month during the pandemic year to women’s accounts.

“This groundswell of women accounts has made her own agency possible. Banks are now able to get a view on her savings and cash flows and offer loans and other products and services,” said Jagannathan. He added that retirement products are crucial for women as they generally outlive men but do not have financial assets.

[ad_2]

Source link