Indian MFs’ global FY21 kitty jumps 3.6x to Rs 21,000 crore – Times of India

[ad_1]

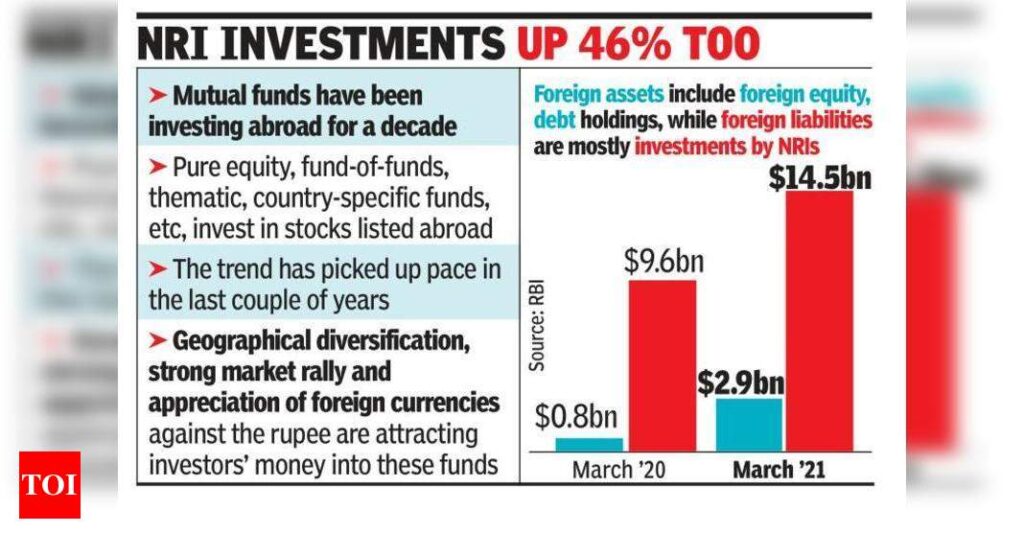

From Rs 5,808 crore as of end-March 2020, total foreign assets of Indian fund houses jumped to Rs 20,865 crore by end-March 2021, data released by the RBI showed. Net foreign liabilities of Indian fund houses, however, showed a rise of just 28% during FY21 to Rs 85,267 crore.

There are several MF schemes in India that invest in stocks listed abroad and the trend has suddenly picked up in the last couple of years. These include pure equity funds that invest part of their corpus abroad, and also international funds that invest abroad through the fund of funds (FoF) and exchange-traded fund (ETF) structure, thematic funds, country-specific funds, etc.

Geographical diversification, strong market rally in the past few years and appreciation of foreign currencies against Indian rupee are among the most compelling reasons for Indian investors to put their money in these funds, industry players said. In addition, a negative correlation between the Indian market and those abroad could also be a reason for Indian investors to put their money there, the sources added.

According to the RBI, most of the money invested by Indian MF investors abroad is concentrated in two countries — the US, which accounts for 43.3% of the total corpus, while 42.5% is in Luxembourg. The balance is distributed between Ireland, Japan, Canada and several other countries.

The central bank’s data also showed that the total liability of Indian MFs increased in FY21 by about 46% to nearly Rs 1.1 lakh crore. These liabilities are mainly in the form of units issued to non-residents. Together, this led to a net liability of Rs 85,267 crore by end-March 2021 — a rise of about 28% over FY20 figures.

Among the dedicated international funds, Motilal Oswal MF’s Nasdaq 100 ETF is the biggest with a corpus of Rs 5,125 crore, data from Value Research showed. Other large ones include Franklin Templeton’s US Feeder fund (Rs 3,919 crore), Motilal Oswal MF’s Nasdaq 100 FoF (Rs 3,631 crore) and Motilal Oswal S&P 500 index fund (Rs 2,058 crore).

In recent months, Mirae MF, IDFC MF, Kotak MF, Axis MF, BNP Paribas MF, SBI MF and HSBC MF launched international funds. Currently, HDFC MF is set to launch its Developed World Indexes FoF — its first dedicated international fund. As the name suggests, this fund will invest in stocks in countries like the US, Canada, Europe, Japan, Australia & New Zealand, Singapore and Hong Kong, brochures from the fund house showed. These markets have very low correlation with India and, since they are diversified across several geographies, it would have low volatility. The fund’s benchmark is the MSCI World Index.

[ad_2]

Source link