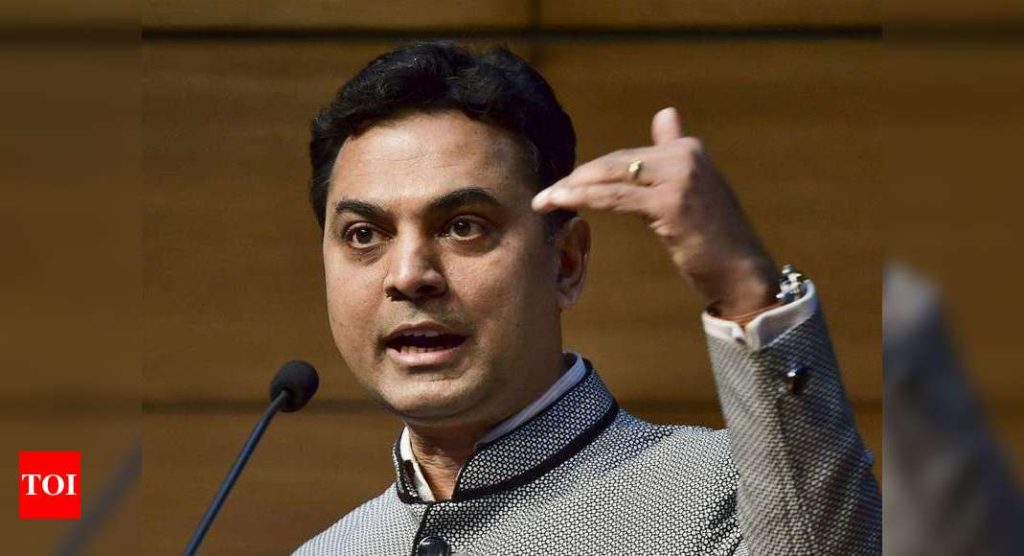

CEA Krishnamurthy Subramanian: I want vaccination’s pace to be faster | India Business News – Times of India

[ad_1]

Will the recent spike in infections threaten economic recovery?

There are a couple of important differences compared to the first wave we had. At that time, there was much more uncertainty about the pandemic, how it would evolve and how to treat. There was no vaccine on the horizon. Given our large population, high density, we had to go for a lockdown for a co-ordinated action. This time, there is a lot more learning — not only on how to contain the pandemic but also on how to treat it. From an economic perspective, I would want the pace of vaccination to be faster.

Coronavirus: Live updates

Does forecast of double-digit growth still stand?

We have projected 11% growth, IMF and OECD have projected higher than that. I don’t see any reason to change the outlook. Expanding the vaccination drive to people over 45 years will have an impact on the demand side as well.

One of the pressure points is prices, both commodity and food prices where there is double-digit inflation for several items. How much of a concern is that?

Inflation in India, especially consumer price inflation, originates a lot from food and the supply-side frictions in the food economy. Vegetables and perishables accounted for inflation during the lockdown and immediately after that. In the last several years, its primarily pulses and oilseeds which are the critical determinants. That is coming primarily from the supply side. What we really need to recognise is that reforms in the agriculture sector and infrastructure, such as cold storage, transportation and warehousing, are going to be extremely important in the medium to long run to avoid periodic bouts of inflation.

Any short-term measure will have some marginal effect but can also have negative effects. Prices of agricultural commodities in one part of the country can be very different in another part. In the US, except the transportation cost, the prices are not very different because there aren’t so many supply side frictions.

Is it time that we include fuel under GST and initiate next set of reforms, including rationalisation of slabs?

GST has stabilised and there has been significant progress over the last few months. This is a good time to start thinking about some rate rationalisation, although it would be good to wait for a few months before deciding on it. Ultimately, the decision has to be taken by the GST Council.

We have seen the fear of interest rates rising.

What is your sense?

Overall demand has picked up in world economy. As a result, there is also a chance of inflation. Central banks may have to respond, although US Fed has made it clear that till 2023, it is not going to change rates. As likelihood of inflation has gone up in the global economy, the global (bond) yields are reflecting that. We are seeing a reflection of that in the yields in India as well. The move towards inclusion of government of India bonds in global indices will help bring down yields significantly.

RBI recently pointed to sharp decline in household savings. How much of a concern is that and will steps such as tax on PF further drive away investors from financial savings?

Deposits have increased. We went through a very uncertain period and during these times, flight to safety is always a phenomenon you see across households. I would wait and watch before saying it is a permanent phenomenon. As uncertainty has reduced, I would expect it to reverse. We have pointed out that savings are pro-cyclical and follow growth, especially when they are favoured by demographics. On the second part, 99% of savers are not affected (by tax on Provident Fund).

[ad_2]

Source link