Actor gets ITAT relief over Rs 30 lakh gift from dad – Times of India

[ad_1]

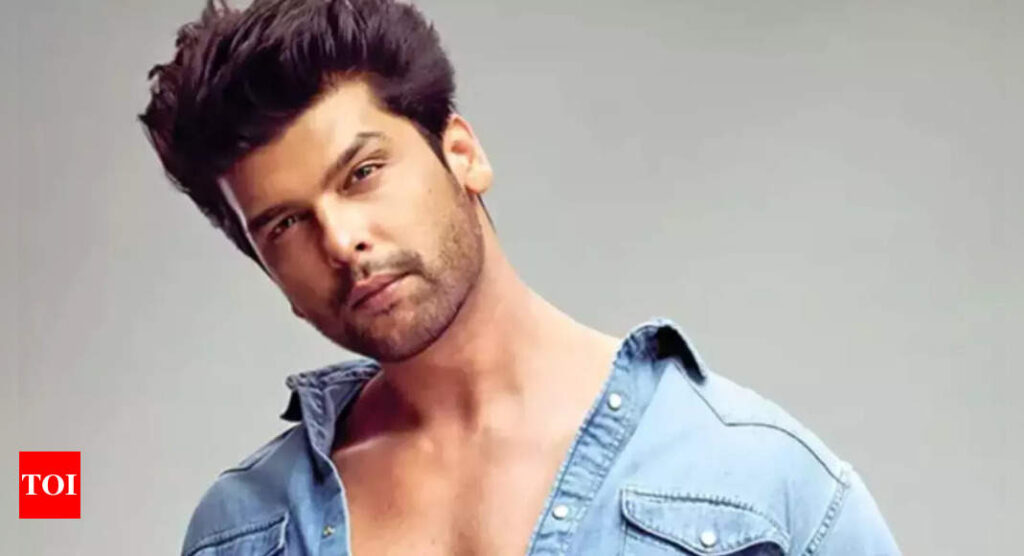

MUMBAI: The Mumbai bench of the Income Tax Appellate Tribunal (ITAT) has held that a gift of Rs 30 lakh received by Bollywood actor Kushal Tandon from his father is not bogus and cannot be treated as unexplained income.

This was one of the disputed tax issues for the financial year 2013-14 for which the actor had filed an appeal with the ITAT. If the tribunal had upheld the gift as an unexplained income (technically known as an ‘unexplained cash credit’), the actor would have had to pay tax on it at a steep rate of 83.25%.

Gifts received from certain relatives (such as parents) are exempt from income tax (I-T) under Section 56 of the I-T Act. However, tax officers tend to examine gifts through a microscopic lens to ensure that no foul play is involved and unaccounted money is not being shown as a gift. If the recipient is unable to substantiate the gift, it is treated as an ‘unexplained cash credit’, which is taxed at a high rate of 60% plus 25% surcharge and also a 6% penalty. The final tax rate is 83.25% approximately.

In this case, Tandon was asked to provide documentary evidence to support the gift transaction. His father’s I-T return for the year in which the gift was made showed an income of Rs 4.12 lakh only. On this basis, the I-T officer held this gift to be an ‘unexplained cash credit’ and sought to tax it accordingly in the actor’s hands.

Tandon submitted to the ITAT that the then limited earnings of the actor were not enough to help him meet his expenses. Thus, his father had come to the rescue of his only son and had gifted this amount out of his past savings. His father, Virendra Tandon, was a regular I-T payer and had disclosed the gift transaction in his financial statements. A gift deed had also been duly submitted to the tax authorities.

However, the ITAT pointed out that the I-T department had failed to take into cognisance that the father had gifted the sum out of his past accumulated savings. In its order, the ITAT said, “We concur with the view taken by the I-T officer that the income shown in the tax return of Virendra Tandon was not substantial. However, a material fact that had been lost sight of by the lower tax authorities is that the actor’s father had never stated that he had gifted the amount in question out of his income for the year under consideration, but had in unequivocal terms stated that the same was given by him out of his past accumulated savings.” The I-T department failed to verify whether the accumulated savings were generated over the years from his income on which income tax had been paid or were from any secret accumulated funds. Instead, the I-T officer rushed through the assessment, added the ITAT order. Based on the entirety of the facts presented to it, the ITAT bench, comprising accountant member S Rifaur Rahman and judicial member Ravish Sood, said the addition of Rs 30 lakh as unexplained cash credit was devoid of any merit.

This was one of the disputed tax issues for the financial year 2013-14 for which the actor had filed an appeal with the ITAT. If the tribunal had upheld the gift as an unexplained income (technically known as an ‘unexplained cash credit’), the actor would have had to pay tax on it at a steep rate of 83.25%.

Gifts received from certain relatives (such as parents) are exempt from income tax (I-T) under Section 56 of the I-T Act. However, tax officers tend to examine gifts through a microscopic lens to ensure that no foul play is involved and unaccounted money is not being shown as a gift. If the recipient is unable to substantiate the gift, it is treated as an ‘unexplained cash credit’, which is taxed at a high rate of 60% plus 25% surcharge and also a 6% penalty. The final tax rate is 83.25% approximately.

In this case, Tandon was asked to provide documentary evidence to support the gift transaction. His father’s I-T return for the year in which the gift was made showed an income of Rs 4.12 lakh only. On this basis, the I-T officer held this gift to be an ‘unexplained cash credit’ and sought to tax it accordingly in the actor’s hands.

Tandon submitted to the ITAT that the then limited earnings of the actor were not enough to help him meet his expenses. Thus, his father had come to the rescue of his only son and had gifted this amount out of his past savings. His father, Virendra Tandon, was a regular I-T payer and had disclosed the gift transaction in his financial statements. A gift deed had also been duly submitted to the tax authorities.

However, the ITAT pointed out that the I-T department had failed to take into cognisance that the father had gifted the sum out of his past accumulated savings. In its order, the ITAT said, “We concur with the view taken by the I-T officer that the income shown in the tax return of Virendra Tandon was not substantial. However, a material fact that had been lost sight of by the lower tax authorities is that the actor’s father had never stated that he had gifted the amount in question out of his income for the year under consideration, but had in unequivocal terms stated that the same was given by him out of his past accumulated savings.” The I-T department failed to verify whether the accumulated savings were generated over the years from his income on which income tax had been paid or were from any secret accumulated funds. Instead, the I-T officer rushed through the assessment, added the ITAT order. Based on the entirety of the facts presented to it, the ITAT bench, comprising accountant member S Rifaur Rahman and judicial member Ravish Sood, said the addition of Rs 30 lakh as unexplained cash credit was devoid of any merit.

[ad_2]

Source link