RBI keeps repo rate unchanged at 4%, maintains accommodative stance – Times of India

[ad_1]

NEW DELHI: The Reserve Bank of India (RBI) on Friday decided to keep key lending rates unchanged in its February policy review meeting.

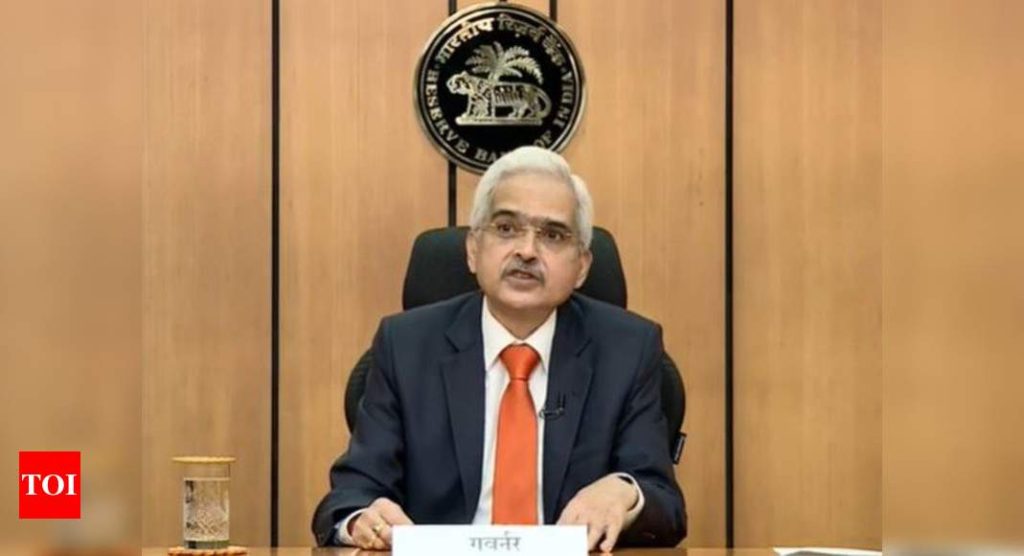

The six-member monetary policy committee (MPC), headed by governor Shaktikanta Das, kept repo rate unchanged at 4 per cent, while maintaining accommodative stance.

Consequently, the reverse repo rate will also continue to earn 3.35 per cent for banks.

Repo rate is the rate at which the RBI lends to banks, while reverse repo rate is the rate at which it borrows from banks.

This is the first MPC meeting after the presentation of the Union Budget 2021-22.

The MPC has kept the key benchmark rate unchanged in its last three reviews. had last revised its policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

The central bank has cut policy rates by 115 basis points since February last year.

RBI mainly factors in the retail inflation while arriving at its bi-monthly monetary policy.

The MPC has been mandated by the government to maintain retail inflation at 4 per cent with a margin of 2 per cent on either side.

CPI inflation eased sharply in December primarily on account of a substantial correction in food inflation — by 5 percentage points — to 3.9 per cent in December from 8.9 per cent in November.

The six-member monetary policy committee (MPC), headed by governor Shaktikanta Das, kept repo rate unchanged at 4 per cent, while maintaining accommodative stance.

Consequently, the reverse repo rate will also continue to earn 3.35 per cent for banks.

Repo rate is the rate at which the RBI lends to banks, while reverse repo rate is the rate at which it borrows from banks.

This is the first MPC meeting after the presentation of the Union Budget 2021-22.

The MPC has kept the key benchmark rate unchanged in its last three reviews. had last revised its policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

The central bank has cut policy rates by 115 basis points since February last year.

RBI mainly factors in the retail inflation while arriving at its bi-monthly monetary policy.

The MPC has been mandated by the government to maintain retail inflation at 4 per cent with a margin of 2 per cent on either side.

CPI inflation eased sharply in December primarily on account of a substantial correction in food inflation — by 5 percentage points — to 3.9 per cent in December from 8.9 per cent in November.

[ad_2]

Source link