Top Stocks: How a Rs 10,000 investment in these stocks grew over the decades | India Business News – Times of India

[ad_1]

IT stocks

Infy: Rs 1.5 crore (1995*)

Infosys is the stuff of middle class dreams. It was founded as an IT services company in 1981 by seven engineers led by N R Narayana Murthy, with an initial capital of Rs 10,000 that Murthy’s wife gave him. It was money she had saved for a rainy day. The same year it signed its first software client, New York-based Data Basics Corporation.

In 1987, it opened its first international office in Boston. Six years later, it introduced an employee stock options programme and the same year, it did a very successful IPO. In 1999, it became the first India-registered company to list on the Nasdaq. As India’s IT revolution took off, and Infy’s share price surged, the widely distributed share structure created numerous dollar millionaires.

TCS: Rs 2.7 lakh (2004)

Tata Consultancy Services launched as a division of Tata Sons on April 1, 1968, as a management and technology consultancy that would create demand for downstream computer services. F C Kohli, a brilliant technocrat, was brought in from Tata Electric Cos to run it. Since the govt mandated that any import of computers must entail exports of twice the value, TCS developed an external market focus.

It started building software for common processes like financial accounting. In 1973, a partnership with American business equipment maker Burroughs resulted in the first recorded instance of an offshore software delivery done out of India, accomplished using automation. These efforts resulted in TCS leading India’s software revolution.

Wipro: Rs 36 lakh (1995*)

Wipro was founded in 1945 in Amalner, Maharashtra, by Mohamed Premji to manufacture vegetable oil. It did an IPO the year after and was listed on the BSE. Mohamed died in 1966, forcing his son Azim to abandon his studies and take over the company. In three decades, Premji took Wipro first into computing hardware, and then into IT services.

It was listed on the NYSE in 2000. India’s IT revolution resulted in Wipro’s revenue and share price surging. Premji’s ownership of 75% of the stock made him one of the richest Indians. The economic benefits of most of those shares are committed to his philanthropic foundations.

Equity culture

RIL: Rs 39.5 lakh (1992*)

Started in 1966 as a small textile manufacturer, RIL has morphed into an enterprise with interests in petrochemicals, oil & gas, retail, telecom and financial services. Its IPO in 1978 introduced the equity culture in India and its market value then was Rs 10 crore.

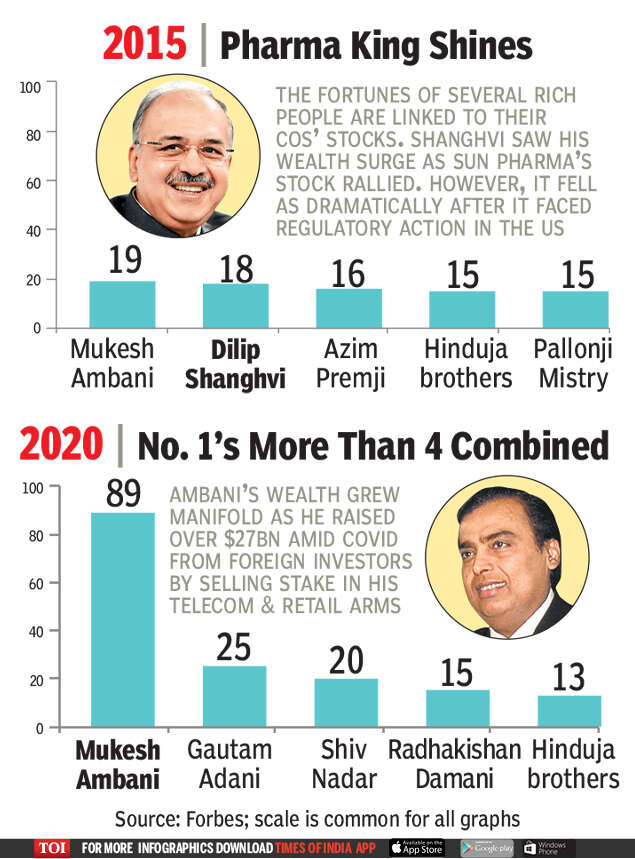

Today, RIL enjoys a market cap of Rs 13.3 lakh crore. After founder Dhirubhai Ambani’s demise in 2002, the empire was divided between his two sons, with the older Mukesh inheriting the flagship, and Anil getting the new-age biz like telecom. In 2016, RIL disrupted India’s mobile services sector with the launch of Jio.

Others

Titan: Rs 42 lakh (1992*)

Started as a watchmaker in 1984, Titan is a JV between the Tatas and the Tamil Nadu Industrial Development Corp. It listed in 1987 and, in 1993, it entered jewellery — now its biggest revenue contributor. Titan also got into perfumes & eyewear. It has emerged as the second biggest jewel in the Tata Group’s crown with a Rs 1.4-lakh-crore mcap after TCS.

Asian Paints: Rs 43 lakh (1992*)

Founded by four friends in the pre-independence era, Asian Paints is a sector leader. It expanded into related areas in the home improvement space from furnishings to lightings. It also launched hand sanitisers and surface disinfectants. RIL holds about 5% stake in Asian Paints, bought in 2008, months before the collapse of Lehman Brothers.

Crisil: Rs 11 lakh (1994)

An S&P arm, the homegrown rating agency has transformed into a global analytics co, generating more revenue from outside the country than from within. The support from a parent, which has a large stake, and Rakesh Jhunjhunwala holding another big chunk has helped the stock.

Financials

HDFC Bank: Rs 37 lakh (1995)

What sets it apart from other performers is the consistency with which it has delivered. It has generated a 20% profit growth over the years, irrespective of market conditions. The bank, which started out by cherry-picking corporate salary accounts for retail deposits, is now a pan-India institution that has cracked the ability to deliver small loans profitably and gained global recognition. Despite its scale, it is on the cutting edge of innovation and gives fintechs a run for their money with its digital strategy.

HDFC: Rs 20 lakh (1993)

HDFC is synonymous with home loans. What makes it a star performer is that despite competition from banks, it is able to maintain its scale of operations without diluting its loan quality. The strict underwriting and a practical approach to loans has resulted in the company having the lowest level of bad loans among all lenders including banks.

What many do not realise is that besides being a housing finance company, HDFC is an investment co holding large chunks of valuable businesses like banking, life & non-life insurance and stockbroking.

Bajaj Finance: Rs 30 lakh (1994)

When Rahul Bajaj split his business between his sons Rajiv and Sanjiv, it looked like the younger Sanjiv Bajaj was getting an offshoot of the main family business. No corporate had cracked financial services. But this was one rare instance where the division of business led to the multiplication of wealth.

Bajaj identified that there were manufacturers and retailers willing to partner lenders who finance the purchase of their products. Also, technology was available to deliver small loans after underwriting customers. The result — a company that is valued at over Rs 3 lakh crore, more than SBI’s Rs 2.6 lakh crore.

Bajaj Finserv: Rs 2 lakh (2008)

While its twin Bajaj Finance gets most of the loans and the market valuation, Bajaj Finserv has the advantage of being a holding company, which owns two extremely valuable insurance businesses. Unknown to most, Bajaj’s insurance joint ventures are the most profitable private insurance companies.

Although two decades ago, Bajaj had contracted to sell a majority stake to foreign partner Allianz if laws allowed it, however, the absence of liberalisation enabled Bajaj to retain a majority in the insurance companies, which continue to thrive as part of Bajaj Finserv group.

Pharma

Dr Reddy’s: Rs 2.2 crore (1991)

Dr Reddy’s Laboratories, listed here in 1991, is one of the first drug companies to be listed on the NYSE. It was set up in 1984 by (late) K Anji Reddy and his associates.

Dr Reddy’s has a diversified manufacturing footprint spread across India, the US, the UK, China and Mexico, and is considered a proxy for foreign investors.

Divi’s Labs: Rs 47 lakh (2003)

Founded by Murali Divi in 1990 after a split from Dr Reddy’s, it’s been on an uptick due to consistent and strong performance. Divi’s is one of the largest generic API manufacturers globally, and an established player in the highly-lucrative CDMO business (contract development and manufacturing organisation) with a strong relationship with six of the top 10 Big Pharma.

Sun Pharma: Rs 31 lakh (1994)

It was started by Dilip Shanghvi in 1983 with a capital of few thousand rupees. Listed in 1994, it is now the world’s fourth-largest generics player. It has had a steady streak upwards, underpinned by lucrative acquisitions like Taro, a strong, diversified portfolio in India, which gives it a commanding share of over 8%. The company’s offerings of branded generics and specialty generics in the US, provide an edge, fetching significant margins.

(* Denotes earliest available mcap date, as listing price data was unavailable)

(Text by Shilpa Phadnis, Mayur Shetty, Reeba Zachariah & Rupali Mukherjee)

[ad_2]

Source link